Think about the retirement plans you offer your employees. While most organizations offer a group retirement plan as an incentive for rewarding employees, many employees would forego this benefit, preferring salary increases instead. While organizations consider this a great form of employee compensation, they must reconsider the ways in which they reward employees and come up with a balance between what makes long-term sense and making employees feel seen and heard in the short term. By contributing salary increases directly to a pension plan or DPSP, the problem is solved.

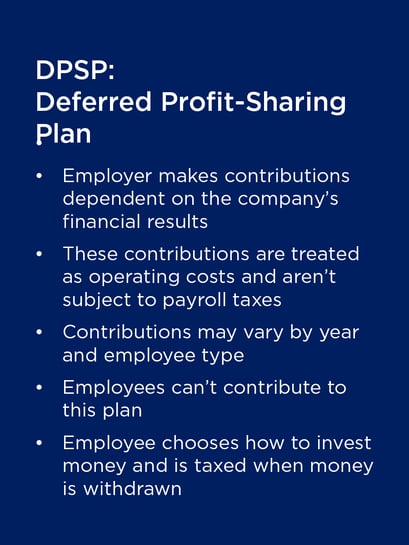

What is a DPSP?

- A Deferred Profit-Sharing Plan (DPSP) is where the employer makes contributions based on the financial results of the company.

- The contributions are treated as operating costs of the company and do not have payroll taxes. These contributions may change by year or the type of employee.

- In this plan, the employee chooses how to invest the funds, but they can’t directly contribute to the plan. The money is taxed when withdrawn.

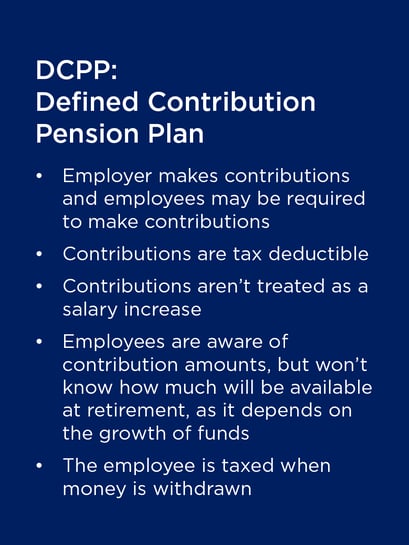

What is a DCPP?

- A Defined Contribution Pension Plan (DCPP) is when the employer makes contributions to the plan, but employees may also be required to contribute.

- All contributions to this plan are tax deductible.

- An advantage of the plan is that contributions aren’t treated as a salary increase.

- Due to fluctuations in the market and growth of the funds, employees know how much is being contributed but they don’t know how much will be available when they retire.

- In this plan, the employee is taxed after withdrawing the money.

Understanding salaries and raises

Wage increases don’t necessarily increase the amount of take-home pay. In fact, a 2% or 3% increase only offers a modest increase in what is taken home. Depending on the province, there are federal and provincial taxes or program deductions that must be factored into the equation. For instance, let’s use a 2.5% increase in pay for the following:

|

|

British Columbia |

Manitoba |

Ontario |

Québec |

|

Take-home pay before increase |

$ 39,825 |

$37,531 |

$39,210 |

$35,561 |

|

Take-home pay after increase |

$40,654 |

$38,304 |

$40,024 |

$36,268 |

|

Annual increase in take-home pay |

$829 |

$773 |

$814 |

$707 |

|

Weekly increase in take-home pay |

$14,03 |

$13.08 |

$13.61 |

$11.56 |

This demonstrates that increases don’t benefit everyone the same.

Creating an effective compensation plan

Employers desiring to engage, attract, and retain top talent while lowering costs should consider contributing to a DPSP or DCPP plan. By doing this, they can bypass payroll taxes that are incurred due to increases in salaries.

Companies that take the time to contribute to these types of plans look good to employees and individuals seeking employment with a company that cares about their futures. These plans demonstrate a long-term commitment to the financial well-being of their employees.

Employees who participate in these types of company-sponsored plans for retirement feel better about the culture, are happy with their workplace, are usually more productive at work, and are committed to helping the company succeed.

This is a perfect situation because it’s a lot easier for employees to contribute small amounts throughout the year rather than one big sum at the end. This makes contributing a lot easier with the prospect of gaining steady returns on their investment over time. This helps with confidence and feelings of security.

Advantages of group retirement plans

Group retirement plans are also beneficial to the company because they have low management fees that equate to more savings at retirement. With an automatic payroll deduction, employees won’t miss the money they don’t see. Employees also benefit because they have immediate relief from taxes because the employer only calculates tax after deducting the contribution to the plan. This means their pay is maximized.

Finding the right choice

Making sure employees are educated on a frequent basis will help them understand why these plans are beneficial and advantageous to their future rather than a salary increase. They equally benefit the employer and employees. For more information on enrolling in a plan, contact the team at People Corporation today.